Pay your Property Taxes

E-transfer

Send to office@daajinggiids.ca.

Automatic deposit is enabled.

Must include your roll number or utility account # and what the payment is for. Contact Village of Daajing Giids (250) 559 4765 for further information.

Mail cheque to:

Village of Daajing Giids

903A Oceanview Drive

Daajing Giids, BC, V0T1S0

Other debit cards cannot be accepted in person.

Office Hours:

12:30pm - 4:30pm Monday - Friday (except holidays)

Dropbox

Can be used outside of business hours.

HOME OWNER GRANTS

Homeowner Grants are a provincial program that incentivizes homeowners by offsetting a portion of the property taxes on the home you live in. On Haida Gwaii, the maximum value of a provincial homeowner grant is $770 for the general population, and $1045 for seniors over 65 and other qualified participants, but it can vary depending on the assessed value of your property.

As of 2021, Homeowner grants are administered by the province. You can no longer apply for your grant on the back of your property tax notice. You must apply online with the Province.

Visit: https://www.gov.bc.ca/homeownergrant. If you are unable to apply online, call 1-888-355-2700 for assistance.

An unclaimed Home Owner Grant is considered outstanding taxes. In order to avoid penalties you must apply for your homeowner grant with the Province by the tax due date. This must be submitted every year.

Permissive Tax Exemptions

BC ASSESSMENTS

Please visit www.bcassessment.ca for information.

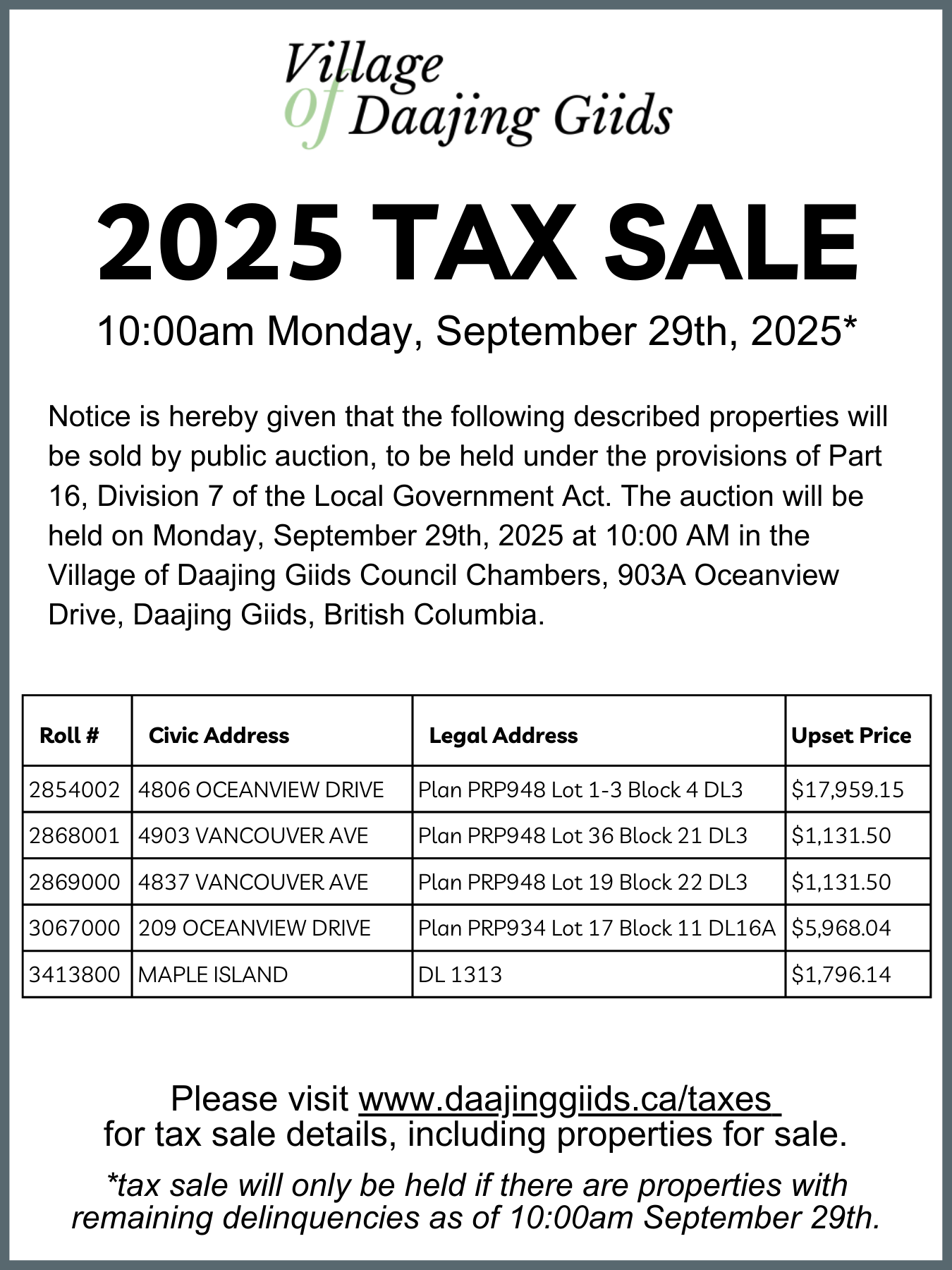

Annual Tax Sale

- The Local Government Act requires municipalities to sell at tax sale all properties whose taxes have not been paid for three years.

- The Local Government Act gives the Collector (the municipality) authority to sell a property for the upset price, which equals all outstanding taxes + penalties + interest + 5% tax sale costs + Land Title Office fees.

- All property sales are "as is" without warrant or guarantee by the municipality.

- Property Tax sales are held on the last Monday of September under the provisions of Part 16, Division 7 of the Local Government Act unless there are no eligible properties for sale.

- To avoid tax sale, a property owner must pay all delinquent taxes before the September deadline. Delinquent taxes are taxes outstanding from three years prior.

- The owner has one year in which to redeem the property, paying back the upset price plus interest accrued to the date of redemption.

- The Village is not responsible for the condition or quality of the properties being offered for sale. It is recommended that you research each property to determine the existence of any bylaws, restrictions, charges, or other condition that may affect the value or suitability of the property. Please do not trespass onto the properties being offered for sale. It would be an infringement on the owner's right.

- In-person attendance is required to participate in the auction.

- Bids must be called out during the auction, and the auctioneer will acknowledge bids received.

- Bidding begins with the upset price and is followed by surplus bids over the upset price

- The highest bidder at or above the upset price shall be declared the purchaser.

- The purchaser has no legal rights to the property until one (1) year has expired from the date of the tax sale.

- The owner has one year in which to redeem the property, paying back the upset price plus interest accrued to the date of redemption.

- At redemption, the purchaser is paid back their bid plus interest accrued from the date of the tax sale.

- Title to property not redeemed within one year from the date of the tax sale will be transferred to the purchaser on receipt of Land Title Act Fee.

- The purchaser will be responsible to pay the Provincial Property Transfer Tax on the fair market value of the property at the time of title transfer.

- If no bidding takes place within three calls by the Collector (auctioneer), the Village is declared the purchaser at the Upset Price.

- At the time of the auction, successful bidders are required to deposit Cash or Bank Draft with the Collector. Failure to remit full payment by the deadline (12:30pm on September 25th) will result in the property being offered for sale again the following day at 10:00 am in Council Chambers.

- Purchasers are required to provide their driver’s licence or BCID Card with their full name and current address, state their occupation and provide their social insurance number.

- Any person placing successful bids on behalf of a company must be prepared to affix the company’s corporate seal to documents.

- The purchase of a tax sale property is subject to tax under the Provincial Property Transfer Act on the fair market value of the property.

Tax Deadlines

For 2025, the deadline to pay taxes is Wednesday, July 2nd, 2025.

- The Village is not responsible for the condition or quality of the properties being offered for sale. It is recommended that you research each property to determine the existence of any bylaws, restrictions, charges, or other condition that may affect the value or suitability of the property. Please do not trespass onto the properties being offered for sale. It would be an infringement on the owner's right.

- In-person attendance is required to participate in the auction.

- Bids must be called out during the auction, and the auctioneer will acknowledge bids received.

- Bidding begins with the upset price and is followed by surplus bids over the upset price

- The highest bidder at or above the upset price shall be declared the purchaser.

- The purchaser has no legal rights to the property until one (1) year has expired from the date of the tax sale.

- The owner has one year in which to redeem the property, paying back the upset price plus interest accrued to the date of redemption.

- At redemption, the purchaser is paid back their bid plus interest accrued from the date of the tax sale.

- Title to property not redeemed within one year from the date of the tax sale will be transferred to the purchaser on receipt of Land Title Act Fee.

- The purchaser will be responsible to pay the Provincial Property Transfer Tax on the fair market value of the property at the time of title transfer.

- If no bidding takes place within three calls by the Collector (auctioneer), the Village is declared the purchaser at the Upset Price.

- At the time of the auction, successful bidders are required to deposit Cash or Bank Draft with the Collector. Failure to remit full payment by the deadline (12:30pm on September 25th) will result in the property being offered for sale again the following day at 10:00 am in Council Chambers.

- Purchasers are required to provide their driver’s licence or BCID Card with their full name and current address, state their occupation and provide their social insurance number.

- Any person placing successful bids on behalf of a company must be prepared to affix the company’s corporate seal to documents.

- The purchase of a tax sale property is subject to tax under the Provincial Property Transfer Act on the fair market value of the property.

An unclaimed home owner grant is considered outstanding taxes and the above penalties apply.

In addition, any unpaid utility balances by December 31st will be transferred to property tax accounts as arrears and thus incurs daily interest.

Failure to pay property taxes by December 31st will put a property tax account into arrears and that unpaid amount will start to accrue daily interest. After another full year, unpaid arrears will become delinquent. Delinquent properties (properties with taxes unpaid for 2+ years) will be put to tax sale by the municipality if not paid by the September deadline.

Permissive Tax Exemption Applications due 4:30pm July 31st annually.

To avoid tax sale, delinquent property taxes must be paid in full by 9:30am Monday, September 30th 2024.

PROPERTY TAXES

Your annual tax bill is calculated based on the assessed value of the property, which is done provincially by BC Assessments, and mailed to homeowners in January of that tax year. That assessed value is multiplied by the tax rate that is set by each agency. The Village of Daajing Giids sets the municipal tax rate and water and sewer frontage tax rates, which is the only portion of your property tax bill that is retained by the Village. The police, school, hospital taxes, library levy and North Coast Regional District taxes are forwarded by the municipality to each agency that provides vital community services.

Municipal property taxes are the most important source of revenue that help to provide the services the municipality is legislated to offer such as water & sewer services, road maintenance, emergency response and other facilities and services the Village runs, including the Youth Centre, cemetery, municipal campground, parks & recreation facilities.

Every year, Council & staff create operating and capital project budgets to ensure the services provided by the municipality are accounted for.

If you wish to review the recordings of the 2024 Financial Plan presentations you may do so by clicking the link below: